20-22 June

St. Petersburg International Economic Forum

Forum website, sponsored by FSU

Saint Petersburg, Russia

Epilogue: I had the opportunity to reflect on the International Forum while strolling the Neva river bank and with Julia Smirnova, marine geologist (aka Miss Polar Lows).

As I explained to Julia, the forum reflects a gathering of glad-handing big shots whose lives are out of touch with everyone else wandering the city streets. But it is also a specific occasion for a collective of events. At the SPB International Forum, new participants are enrolled into frameworks of understanding, truths emerge even as disagreement and distrust remain.

At the SPB International Forum, new participants are enrolled into frameworks of understanding, truths emerge even as disagreement and distrust remain.

Attention to certain individuals (career, attitudes) intensifies.

There is continual display of fleeting phenomena (modes of talking, attire), over which various actors converge and publicly declared their interests. It is a public relations moment for different interests.

In short, the Forum represents (and reproduces) a formula of need, that reflects the nature and degree of interdependences that hold together various persons and groups — forming, in this case, Russian economy – interdependencies that always require the so-called owners (State), de facto owners (oligarchs), investors (businessmen), and so forth.

At the time, during our conversation, four possibilities emerged from my own thought about the experience: (1) The Mirror of Media Democracy; (2) The Space of Governance through Reflection; (3) Hard [Business] Truths; (4) An Event of Our Time.

At the time, during our conversation, four possibilities emerged from my own thought about the experience: (1) The Mirror of Media Democracy; (2) The Space of Governance through Reflection; (3) Hard [Business] Truths; (4) An Event of Our Time.

Day Three

6/22: Enhancing Russian Corporate Governance Standards.

This panel was well attended. I sat in the front row next to capital investor Drew Gruff, who has been in and out of Russia for some 20 years. The meeting focused on the problems of recruiting high quality directors for company boards with participants giving a range of suggestions, including implementing American standards that ensure honesty, integrity, and personal liability. Olga Dergunova, Deputy Minister of Economic Development, Head of the Federal Agency for State Property Management of the Russian Federation, was the moderator and began the discussion soliciting new proposals for changes to the Corporate Governance/ Behavior Code.

Dmitry Pankin. On the backdrop of the financial crisis, a lot of information about how management should develop, renumeration has become key, a central topic in discussion of amendments to corporate behavior code.

Definition of independent directors, what are criteria of independence of board members, what percentage of shares can be owned by an independent director to be recognized as such. Another issue is disclosure requirements, how does a company disclose information (to shareholders), alternatives include companies not providing sensitive information that may be deemed as damaging the company, we are still collecting comments. Question by Andrei Bugrov, Deputy Chairman of the Board of Directors, Non Officer, Member of the Management Board, Interros Holding Company. “What part of what you said applies to state owned companies?”

Definition of independent directors, what are criteria of independence of board members, what percentage of shares can be owned by an independent director to be recognized as such. Another issue is disclosure requirements, how does a company disclose information (to shareholders), alternatives include companies not providing sensitive information that may be deemed as damaging the company, we are still collecting comments. Question by Andrei Bugrov, Deputy Chairman of the Board of Directors, Non Officer, Member of the Management Board, Interros Holding Company. “What part of what you said applies to state owned companies?”

Olga speaks, Corporate Behavior Code, which will be replaced by Corporate Governance Code, will provide more detailed language for business ethics. But how is the current level of governance appreciated by international community?

Olga speaks, Corporate Behavior Code, which will be replaced by Corporate Governance Code, will provide more detailed language for business ethics. But how is the current level of governance appreciated by international community?

David Gray, Managing Partner, PwC Russia. The new code is a good step in the right direction, but there is still this perception that Russia is still a place where normal standards are absent, but Russia has made a lot of progress in the past few years, especially in the quality of directors. We have a board survey every year, and a key issue is the quality of candidates in the board. Lack of depth in corporate Russia, especially human capital, technical or financial persons, improvements around the quality of directors is a very practical step.

Olga: Quality of corporate directors is important. Andrew Bugrov: One of the realizations emerged from financial crisis, the importance of independence is exercised, but at the expense of expertise, extremely difficult to enroll qualified directors in the boardroom.

Olga: Quality of corporate directors is important. Andrew Bugrov: One of the realizations emerged from financial crisis, the importance of independence is exercised, but at the expense of expertise, extremely difficult to enroll qualified directors in the boardroom.

Ronald Freeman, Independent Director, Member of the Audit Committee of the Board of Directors, Severstal. If I can add, I am always surprised how self-critical Russians can be. The best Russian corporations have closed the gap between what is written in the code and behavior. How have they done that? The best Russian companies, they want to hear, they demand a diversity of viewpoints, and I’ve seen them change their minds in the course of board meetings. On the other hand, Board of directors have to be prepared, they need to come in ready to do the job right, extremely demanding, preparing. We need to talk more about government of government.

Olga: Quality directors, the ability to get ready and analyze the outcomes on a regular basis, is the second major factor of a quality board. Where is that incubator that can put out directors, not just for Sberbank, but for the 2500 other companies that require independent directors? What is the essence of approach for putting together a quality group?

Olga: Quality directors, the ability to get ready and analyze the outcomes on a regular basis, is the second major factor of a quality board. Where is that incubator that can put out directors, not just for Sberbank, but for the 2500 other companies that require independent directors? What is the essence of approach for putting together a quality group?

Dimitry Peskov responds, we do an open procedure, there is an option to file an offer or bid, we look at the competencies of the person, if we can track that down, you can offer tasks for those people, and can identify their clearest manifestations of competency, we more or less understand the competence of an industry and can therefore model a board of directors, whether be charged with making a certain decision, making a foresight, and based on that, persons from all walks of life can be selected, and then we need to balance them in terms of ethical qualities.

Andrei: Is there not a corporate universal exam [referring to Olga to ask how does the state select their board of directors]?

Olga: We have as the state, 2014, independent directors, and we saw that there is corruption in that certain individuals want to work somewhere, and also expertise in one area does not always translate into pragmatic competence. So we came up with a basic set of requirements, certificates of education, chartered experts, and comparing all those requirements, and looking for financial and economic experience within the requirements of a company, but government requires a more universal approach to the selection process, and requires having a system put in place, of codes and laws of professional conduct. Alexander, what advice would you give to corporations to satisfy investors?

Alexander Afanasiev, indeed, we are interested in directors, the project to develop the new code of corporate governance is of interest to us, because we are pragmatic beneficiaries of the process, openeness and transparancy of markets provides access to funding. You have to convince shareholders, lenders, government officials, corporate governance plays an important role. According to my personal experience, perception, how you think about the market, lags very much behind in Russian markets, a legacy from the Soviet saying, that the office is stronger than the industry, but we have made advancements quickly, obtaining and protecting assets is not a formula for openness.

Alexander Afanasiev, indeed, we are interested in directors, the project to develop the new code of corporate governance is of interest to us, because we are pragmatic beneficiaries of the process, openeness and transparancy of markets provides access to funding. You have to convince shareholders, lenders, government officials, corporate governance plays an important role. According to my personal experience, perception, how you think about the market, lags very much behind in Russian markets, a legacy from the Soviet saying, that the office is stronger than the industry, but we have made advancements quickly, obtaining and protecting assets is not a formula for openness.

Now it is different, owner is separate from management, and owner, shareholders and managers. Here the concentration of capital is high and securing the rights of minority sharelholders is high. Good corporate governance pays back. There is a certain premium for corporate governance.

Olga, continuing on the thesis of listing, information about the company, performance, transparency, not only increasing opportunity to take loans at lower rates, and here my question is to Albert, the NYSE is stringent about reports, and the sanctions when they are found invalid, and what would you recommend.

Olga, continuing on the thesis of listing, information about the company, performance, transparency, not only increasing opportunity to take loans at lower rates, and here my question is to Albert, the NYSE is stringent about reports, and the sanctions when they are found invalid, and what would you recommend.

Albert Ganyushin, Head of International Listings, NYSE Euronext. Both in US and Europe there are very strict standards. In Russia, a European approached based on OECD is more widespread. The US described: a set of rules is quite narrow, but you have to ensure 100 percent compliance, why is this system good? because it raises the corporate governance to a minimum capital level, which creates a mark below that you cannot operate, as a result, the US is the most developed in the world, why was it done?

Strict compliance with minimum standards, provide valid reporting, and there are no other approaches in the American market, what does that mean in Russian market, I think there should be strict compliance. The head of a company should sign a paper and state he will not lie.

And if a company is ready to do that then the company is ready to operate. Since Russia prioritizes building an affective capital market, the process could be accelerated, and the process takes some time, but could focus on a minimum standard. If you own the company you can make your own rules, but if you want to attract investors at a low price, then the minimum set of standards could help. One more thing, companies in Moscow and NYSE, we advocate that we work together and there shouldn’t be any problem following these problems and that helps promote corporate culture.

And if a company is ready to do that then the company is ready to operate. Since Russia prioritizes building an affective capital market, the process could be accelerated, and the process takes some time, but could focus on a minimum standard. If you own the company you can make your own rules, but if you want to attract investors at a low price, then the minimum set of standards could help. One more thing, companies in Moscow and NYSE, we advocate that we work together and there shouldn’t be any problem following these problems and that helps promote corporate culture.

Q: Andrei Bugrov, what are the most common mistakes? A: Usually, companies choose too many indicators, which is useless, and make people aware of indicators, and that they have to work within a framework, when the system starts operating, the main thing is not to go mad, because the system starts providing so much information, and it takes a lot of time and effort, and so has to avoid erroneous decisions, however, nothing more successful has been invented yet.

Q: Andrei Bugrov, what are the most common mistakes? A: Usually, companies choose too many indicators, which is useless, and make people aware of indicators, and that they have to work within a framework, when the system starts operating, the main thing is not to go mad, because the system starts providing so much information, and it takes a lot of time and effort, and so has to avoid erroneous decisions, however, nothing more successful has been invented yet.

Freeman, adding, good board acts like a good string quartet, board effectiveness, you know what it is when you see it. Directors can be dismissed on an annual basis and retained collectively. Andrei, reaffirming that Freeman’s comments are important.

Freeman, adding, good board acts like a good string quartet, board effectiveness, you know what it is when you see it. Directors can be dismissed on an annual basis and retained collectively. Andrei, reaffirming that Freeman’s comments are important.

Michael Kleinemeier, President, SAP in Middle and Eastern Europe, Maksim Krasnyih, Director for Russia and CIS, Intel Capital, Andrei Volkov, Rector, Moscow School of Management Skolkvovo

Russia’s Green Agenda: A Sustainable Approach to Drive Russian Productivity and Competitiveness. Speaking now is Sergei Yefimovich Donskoy, Minister of Natural Resources, speaking of Russia’s adoption of a state plan for green initiatives, “Arctic zone development” — a road map for environmental regulation, focusing on mitigation of previous environmental impacts, recycling and modernization of industry.

Law on technological regulation and incentives, less red tape, use of electronic data bases, oversight performance of regulation, for environmental concerns. Safe handling of wastes is another important issue, requiring decisive measures or Russia will become a “big dump site”, establishing a new industry for treating solid waste, requiring changes in legislation, adoption no later than spring 2014. Also within our green policies, protection of Baikal lake and surrounding areas. Key areas of the nation, environmental impacts, every year a billion tons of waste, hundreds of thousands of hectares, putting in place a list of priorities for 45 regions, allocation 120 billion rubles, total investments in environmental sector will increase to double current rate, seeking to clarify areas for efficiency of investments

Law on technological regulation and incentives, less red tape, use of electronic data bases, oversight performance of regulation, for environmental concerns. Safe handling of wastes is another important issue, requiring decisive measures or Russia will become a “big dump site”, establishing a new industry for treating solid waste, requiring changes in legislation, adoption no later than spring 2014. Also within our green policies, protection of Baikal lake and surrounding areas. Key areas of the nation, environmental impacts, every year a billion tons of waste, hundreds of thousands of hectares, putting in place a list of priorities for 45 regions, allocation 120 billion rubles, total investments in environmental sector will increase to double current rate, seeking to clarify areas for efficiency of investments

Andrei Elinson, Deputy Chief Executive Officer, Basic Element, Chairman of the Board, Basel Aero. Our own 70 person working team has been evaluating current legislation, continues with a legacy with command and control. An average permit in the current system require 1-1.5 years, whatever enterprise, you need to fill out hundreds of documents. Issues like “damage” does not have a precise definition, with more than 1500 regulating documents, describing various relations of various bodies in the country. Competitiveness should be a main driver in greening the environment and many companies are moving toward environmental awareness as part of their development models.

Andrei Elinson, Deputy Chief Executive Officer, Basic Element, Chairman of the Board, Basel Aero. Our own 70 person working team has been evaluating current legislation, continues with a legacy with command and control. An average permit in the current system require 1-1.5 years, whatever enterprise, you need to fill out hundreds of documents. Issues like “damage” does not have a precise definition, with more than 1500 regulating documents, describing various relations of various bodies in the country. Competitiveness should be a main driver in greening the environment and many companies are moving toward environmental awareness as part of their development models.

Sergei Donskoy, Minister of Natural Resources, apologizes for being emotional, but reasserts that environmental legislation requires attention. Isaac Sheps, President, Baltika Breweries, Senior Vice President, Eastern Europe, Carlsberg Group. 40 percent of waste revolves around packaging, so we have been looking to recycle and reuse for new packaging, the brewery way of sustainability. Clusters of sustainable industry around our brewery, establishing glass and can factories near the brewery to save on transportation costs in recycling.

Alexander Chuvaev, Executive Vice President, Fortum Corporation, Russian Division, pointing out the modern capacities of electricity generation in Sweden, and increasing reliance on natural gas.

Natalia Khanjenkova, Managing Director, European Bank (EBRD) Russia. 240 billion Euros to bring Russia up to environmental standards equivalent to Europe. Russia consumes energy 2 or 3 times more than other countries.

Evgeny Schwartz, Director of Conservation Policy, WWF Russia. Global economy is indeed globalized. Environmental sensitivity in Russia is especially visible in Russian forestry, industry is very supportive of environmentalists, why it is important to treat Russia as a global basis, positioned between environmentalist Europe and not so environmentally sensitive China, consumers on one hand and producers on the other hand, China is beginning to demand sustainable timber products to meet European Union legislation surrounding environmental protection involved in production for imports.

Evgeny Schwartz, Director of Conservation Policy, WWF Russia. Global economy is indeed globalized. Environmental sensitivity in Russia is especially visible in Russian forestry, industry is very supportive of environmentalists, why it is important to treat Russia as a global basis, positioned between environmentalist Europe and not so environmentally sensitive China, consumers on one hand and producers on the other hand, China is beginning to demand sustainable timber products to meet European Union legislation surrounding environmental protection involved in production for imports.

Oil and Gas, and Mining, needs work, the worst industry is the financial segment. The bill currently being reviewed and discussed (environmental legislation) — categorizes projects, assessment of environmental impacts, should protect small and medium business interests.

Oil and Gas, and Mining, needs work, the worst industry is the financial segment. The bill currently being reviewed and discussed (environmental legislation) — categorizes projects, assessment of environmental impacts, should protect small and medium business interests.

James Rosenfield, the right path for Russia is that one unique for Russia, looking at a global scale, start with the point made by everyone here, of energy efficiency, the 5th fuel at CERA, efficiency, Second, great energy technology contributions and enthusiasms for that, Skolkovo start up village, privileged to present on renewable, and sat through 50 start up businesses on renewables, and amazing to see what Russian technology has to offer the rest of the world, and that prime minister Medvedev attended, and that leadership has to start at the top, so having Donsky here is important.

Great rebirth of renewable energy wave, 1970s, response to oil shock, small scale, but today, massive worldwide build up of modern supply chains, creating massive electricity generation all around renewables, while in emerging markets it is 15 percent of green energy, one trillion dollars in past 3 years invested in green energy, meeting climate concerns but also growing energy demand, and that response to fears of peak demand, but also more recently a reversal in green energy because of financial meltdown and shale gale has a powerful mindset on the concept of scarcity, growing awareness of hydrocarbon abundance, and the “green spread”, the costs associated with renewables, is widening, originally had thought to decrease, and there is a reconsideration of renewable energy. On the supply side, an over supply of renewables, solar and wind have twice the capacity to meet demand, and we’re seeing consolidation in industry, with prices dropping for solar, and also a change in attitudes in Silicon Valley toward greentech, as folks settle in to longterm advances.

Great rebirth of renewable energy wave, 1970s, response to oil shock, small scale, but today, massive worldwide build up of modern supply chains, creating massive electricity generation all around renewables, while in emerging markets it is 15 percent of green energy, one trillion dollars in past 3 years invested in green energy, meeting climate concerns but also growing energy demand, and that response to fears of peak demand, but also more recently a reversal in green energy because of financial meltdown and shale gale has a powerful mindset on the concept of scarcity, growing awareness of hydrocarbon abundance, and the “green spread”, the costs associated with renewables, is widening, originally had thought to decrease, and there is a reconsideration of renewable energy. On the supply side, an over supply of renewables, solar and wind have twice the capacity to meet demand, and we’re seeing consolidation in industry, with prices dropping for solar, and also a change in attitudes in Silicon Valley toward greentech, as folks settle in to longterm advances.

60 countries are invested in renewable portfolios, and emerging markets are more interested, however, “economic competitiveness” is continually driving the discussion around renewable and environmental developments, and this is having an effect in Western Europe, with Germany industrial community requesting a relax from high cost decisions surrounding supply. 10 percent of global capacity by 2025.

60 countries are invested in renewable portfolios, and emerging markets are more interested, however, “economic competitiveness” is continually driving the discussion around renewable and environmental developments, and this is having an effect in Western Europe, with Germany industrial community requesting a relax from high cost decisions surrounding supply. 10 percent of global capacity by 2025.

My big recommendations, besides the cornerstone of efficiency. Focus on remote off grid sectors, Vladivostok versus Moscow, second, rationalize structure, you have heat and no power, third, solid waste problem, use technologies for energy generation; next leverage your low cost gas resource, a myriad gas enabling technologies, finally, leverage your competitive advantage in science and technology in R and D, material sciences, bio sciences. The green story will take some time to unfold in Russia, but when it happens it will take place very quickly. With patience and time you will see a different energy future in Russia.

My big recommendations, besides the cornerstone of efficiency. Focus on remote off grid sectors, Vladivostok versus Moscow, second, rationalize structure, you have heat and no power, third, solid waste problem, use technologies for energy generation; next leverage your low cost gas resource, a myriad gas enabling technologies, finally, leverage your competitive advantage in science and technology in R and D, material sciences, bio sciences. The green story will take some time to unfold in Russia, but when it happens it will take place very quickly. With patience and time you will see a different energy future in Russia.

Keynote Speeches

Keynote Speeches

Russian President Vladimir Putin and German Chancellor Angela Merkel

Vladimir Putin, responding to comments, including in the New York Times today, that Russia continues to not be the best environment for foreign investment. In the key note, Putin responds to these concerns, by stating he/Russia is committed to protecting the rights of minority investors, create tax incentives for citizens to invest in capital markets, modernize financial regulation, curb offshore financial instruments (offshoring of world economy).

Here, Putin mentioned a number of energy infrastructure projects, including LNG terminals and increased movements of oil and gas to China and Asia. Accessible bank credit especially for SME’s, giving banks opportunities to lower costs from removing regulatory accounting procedures. Creating a better more reliable business climate.

Here, Putin mentioned a number of energy infrastructure projects, including LNG terminals and increased movements of oil and gas to China and Asia. Accessible bank credit especially for SME’s, giving banks opportunities to lower costs from removing regulatory accounting procedures. Creating a better more reliable business climate.

Our investment image and internal perception, depends upon our (government) actions to improve business climate “de-penalize” commercial disputes, at the judicial level, municipal and state bodies, unite supreme court and arbitration court of Russia, intend on asking parliament and judiciary, to establish a “business ombudsman” with certain powers for defending the interests of the business community in relation to government, including suspending acts taken by municipal authorities, giving class action suits [?].

Our investment image and internal perception, depends upon our (government) actions to improve business climate “de-penalize” commercial disputes, at the judicial level, municipal and state bodies, unite supreme court and arbitration court of Russia, intend on asking parliament and judiciary, to establish a “business ombudsman” with certain powers for defending the interests of the business community in relation to government, including suspending acts taken by municipal authorities, giving class action suits [?].

Yet another government proposal, to declare amnesty for certain individuals who have committed serious offense of the state, money counterfeiter, Draft amnesty, has been read by the business community. According to this draft amnesty, crimes related to entrepreneurial activity, economic amnesty not only restores justice, but a chance to reorganize a space for entrepreneurial institutions, respecting entrepreneurs and law.

Human capital. Health care and education, social changes in economy… abstract figures of industrial growth should not be our ultimate goal.

Angela Merkel is up now, talking about globalization, how it can and should be shaped. Working toward the G20 coming up, and emphasizing global free trade, accept competition from all over the world. European Union, Free trade region established between EU and USA, drawing down barriers to trade. Russia also wants to establish ties, to EU, USA, Pacific region. Germany wishes to support Russia’s efforts to diversity its economy, trade increasing between the two countries, especially in the energy sector, the energy mix will depend for a very long time on natural gas, of tremendous importance, Nord Stream, a forward looking project for energy transportation, a “truly European project” — Gazprom, Rostneft, we are also having German companies in the exploitation (upstream) here in Russia, standing ready to cooperate very closely.

Angela Merkel is up now, talking about globalization, how it can and should be shaped. Working toward the G20 coming up, and emphasizing global free trade, accept competition from all over the world. European Union, Free trade region established between EU and USA, drawing down barriers to trade. Russia also wants to establish ties, to EU, USA, Pacific region. Germany wishes to support Russia’s efforts to diversity its economy, trade increasing between the two countries, especially in the energy sector, the energy mix will depend for a very long time on natural gas, of tremendous importance, Nord Stream, a forward looking project for energy transportation, a “truly European project” — Gazprom, Rostneft, we are also having German companies in the exploitation (upstream) here in Russia, standing ready to cooperate very closely.

Looking for transparent rules in business development, and here Germany can be a good partner, of tremendous importance, in the long run, we can only be prosperous if the entire of EU is prosperous, Russia always stood by our side, making a commitment to the Euro, and we have shown in the Eurozone, that politically, we have committed ourselves to the Euro, though trust from investors had eroded during the financial crisis, whether countries could repay their debt.

Management of economies, sound fiscal policy will loom large at the G20 meeting. Competitiveness, each country will need to prevail in competition, structural reform, respond to sound fiscal policy, that each country requires to reclaim competitiveness. Lending is a big deal in SMEs, and set up a particular lending institution sponsored by the government. Economic coordination, research and development, unit labor costs, cannot be great disparity within the EU zone.

Management of economies, sound fiscal policy will loom large at the G20 meeting. Competitiveness, each country will need to prevail in competition, structural reform, respond to sound fiscal policy, that each country requires to reclaim competitiveness. Lending is a big deal in SMEs, and set up a particular lending institution sponsored by the government. Economic coordination, research and development, unit labor costs, cannot be great disparity within the EU zone.

Arguably, the high unemployment rate among young people, is the most pressing issue in Europe. Greater need for coordinated labor market.

Zhang Gaoli, Vice Premier, People’s Republic of China. Allow me to congratulate you on the successful opening of the forum and stimulating global economic growth. There are certain positive changes given uncertainty. We do not have enough drive behind global economic growth. Undertake steps to support open environments (business), international trade based on free and rational exchange.

Q & A. Economic Summit. Serious reaction to US Federal reserve board policy.

Putin — what Russia should do is covered in my remarks. Adjustment is needed as some point, esp. with continued liquidity in the market, and it is not right to expect the world to follow America’s ongoing series of fiscal cliffs, including reducing debt burden by the Fed, which Obama did respond to at the G8.

Putin — what Russia should do is covered in my remarks. Adjustment is needed as some point, esp. with continued liquidity in the market, and it is not right to expect the world to follow America’s ongoing series of fiscal cliffs, including reducing debt burden by the Fed, which Obama did respond to at the G8.

Merkel, responding to policies good for Germany not necessarily good for Europe, making a brief comment, referring to the previous comment about Bernake, that high liquidity was the cause of the past financial crisis, but the reaction shows that we are not back at full balance. But actions of the Fed should not be creating such global fluxes, but just points out how global changes are dependent upon global banks. Secondly, the big deficits suggest that sovereign bonds are nothing to invest in.

Question: Potential exports of natural gas from the United States, projected flat demand for gas in Europe and high prices for natural gas in Asia, suggests that Arctic oil and gas for export to Asia make sense, but requires technology and investment. In the Barents Sea, a number of Norwegian and Russian workshops suggests that Russia is not open enough to foreign investment and partnerships in the Arctic development sector, can you comment?

Daniel Yergin Question: how do you see developments in oil and gas and what is Russian strategy for handling new developments.

Daniel Yergin Question: how do you see developments in oil and gas and what is Russian strategy for handling new developments.

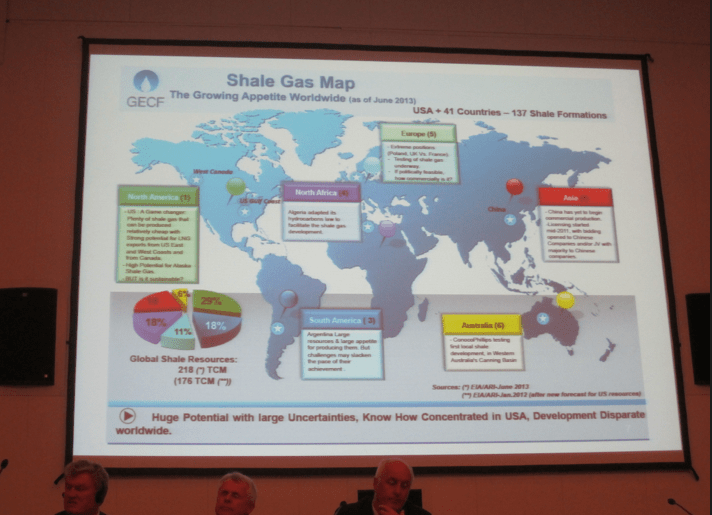

Putin: I do not see any cardinal change. US shale gas affecting economy today, but fundamentally we have not seen big changes. And that shale gas is creating more problems that fundamentally changing the price. I do not serious change, but cardinal changes in technology would be best, we should assume that cheap energy will not be available and new technology.

Day Two

6/21: Day two. Energy Club Summit: Reshaping Global Oil Markets. Moderator, Dr. Daniel Yergin. I have yet to obtain tickets to attend this meeting. Only special invitation is allowed. I view it on one of the screens, or in this case, on front page of the SPIEF which has a live stream of this event.

Already one hour late in getting started and any later, it will overlap with the main event of the day, which is a key note by Vladimir Putin. I met Yergin yesterday. We spoke briefly about what I am up to. Years ago, I worked with the Alaska governors, Tony Knowles and Frank Murkowski. We engaged with CERA. On a few occasions, I lunched with Knowles and Yergin.

The Economics of Managing Major Catastrophes. Moderator, Margareta Wahlström, Special Representative of the UN Secretary General for Disaster Risk Reduction.

The Economics of Managing Major Catastrophes. Moderator, Margareta Wahlström, Special Representative of the UN Secretary General for Disaster Risk Reduction.

Context, Economic impact on industry of catastrophes, obviously, taking this panel from the private sector perspective. Costing enormous values economically, socially, politically — with aspirations for economic growth, that creates catastrophic future risk, disaster risk accumulation in East Asia and economic growth curve, who pays, how do we manage increasing global context and abilities to build resilience.

Business is lending toward higher risk regions, how do they think about risk, do they calculate them into their investment decision making, what are their instruments, what is the collaboration between the public and private, where is the leadership coming from, what are shared values.

Business is lending toward higher risk regions, how do they think about risk, do they calculate them into their investment decision making, what are their instruments, what is the collaboration between the public and private, where is the leadership coming from, what are shared values.

Vladimir Puchkov, Minister of the Russian Federation of Civil Defense, Emergencies and Elimination of Consequences of Natural Disasters. Infrastructure bigger, new branches of economy, bringing IT to most remote places. External factors are different, climate changes, emerges of new risks and threats, earthquakes, tornadoes, etc. requires taking under many factors.

We are taking all necessary measures to minimize risk. Putin has approved strategy on G20, for security, NGOs also very involved. In order to implement this strategy, state system on prevention, unified system of 83 regions of Russia, involves early detection of threats that may emerge. We have build a modern regulatory base just three years ago, and today more than 3000 enterprises in FSU have been required to decrease risk. Step by step we are reducing the number of non-liscensed activities. For example, if a CEO takes on certain obligations on he files [?].

Sochi Olympics, for example, many different security professionals were involved during different stages, construction, etc., safety and security. Establishing the reserve systems (reserve fund) operating in the area risk reduction, providing necessary help for certain regions, and money subsidies to populations, entitling folks to 10k rubles and up to 100k rubles for property loss.

Sochi Olympics, for example, many different security professionals were involved during different stages, construction, etc., safety and security. Establishing the reserve systems (reserve fund) operating in the area risk reduction, providing necessary help for certain regions, and money subsidies to populations, entitling folks to 10k rubles and up to 100k rubles for property loss.

Reimbursements cover immediate needs in the wake of disasters. Educating populace about disaster mitigation (threats, natural disaster relief). International cooperation for forecasting disasters and risk management issues, shaping new models that effectively allow us to manage societies, we need to be able to invest in protection of critical infrastructure, but finding a balance, draw a border line, that we are safe but that our businesses have resources, that they operate in a safe environment, but that they operate indeed. And Russia operates within a variety of multinational networks. Forecasting and prevention is key, putting together powerful international tools that allow us to enable improve our decision making process.

Reimbursements cover immediate needs in the wake of disasters. Educating populace about disaster mitigation (threats, natural disaster relief). International cooperation for forecasting disasters and risk management issues, shaping new models that effectively allow us to manage societies, we need to be able to invest in protection of critical infrastructure, but finding a balance, draw a border line, that we are safe but that our businesses have resources, that they operate in a safe environment, but that they operate indeed. And Russia operates within a variety of multinational networks. Forecasting and prevention is key, putting together powerful international tools that allow us to enable improve our decision making process.

Margareta sums up, “Thank you Minister, economic models, public awareness, financial instruments, government capacity to provide safe environments, business response.” Safety should be an industrial requirement.

Gill Grady, Senior Vice President, Corporate Business Development, GSE Systems. Minister set up my discussion quite well, what private industry can be doing. If we think about disasters, things we can control, things we cannot control.

Gill Grady, Senior Vice President, Corporate Business Development, GSE Systems. Minister set up my discussion quite well, what private industry can be doing. If we think about disasters, things we can control, things we cannot control.

Let’s talk about Human Performance, design of plants, whether regulation we have developed is meeting its intended purpose. Introduce regulation and improve safety, what assumptions are we making. If we develop new operating procedures will they be perfect, no.

Where do humans get experience on new events, are worst case scenarios actually worst case, nuclear power industry, the methodology of probabilistic approach and likelihood of things going wrong and building our models around it.

Assumptions of Fukushima, 10 meter wall (14 meter tsunami), back up generators (affected by water), response time. Fukushima gives us an opportunity to make assumptions and new regulations. Where can technology help us, the use of technology and the importance of training operators, simulation based technology and the real risks — industrial, natural, disaster and intentional disaster. Accident assessment technologies.

Different industries handle risks differently. But we can take another step further. Not a big proponent of new regulation, incrementally changed without understanding the total affect. Russia’s capacity to take a look at the whole picture of risk based approach to analyzing the safety of their industries. Sometimes, we have more strict conditions over how someone drives a car versus a running a billion dollar chemical plant.

Different industries handle risks differently. But we can take another step further. Not a big proponent of new regulation, incrementally changed without understanding the total affect. Russia’s capacity to take a look at the whole picture of risk based approach to analyzing the safety of their industries. Sometimes, we have more strict conditions over how someone drives a car versus a running a billion dollar chemical plant.

Question from the audience: How do you register thresholds of intentional disaster? Isn’t running down our natural capital in the name of economic growth an intentional disaster?

Valery Akimov, Head of the All-Russian Research Institute for Civil Defense and Emergency Situations of the Russian Emergencies Ministry, Doctor of Technical Sciences, Professor. Risks are growing at faster rates than GDPs, two-fold task, either to grow faster economically, or reduce risks, and reduce material casualties.

Valery Akimov, Head of the All-Russian Research Institute for Civil Defense and Emergency Situations of the Russian Emergencies Ministry, Doctor of Technical Sciences, Professor. Risks are growing at faster rates than GDPs, two-fold task, either to grow faster economically, or reduce risks, and reduce material casualties.

Outline several scientific problems. The ministry manages to allocate necessary funds for technology and science. Science cannot do any long term prediction of disasters, but there may be a time where we could predict, or predict with some accuracy, or theory of risk management.

Classic theories of probability has not worked out well, predicting that, for example, flooding in certain regions would not occur again, and within a few years of the prediction, flooding took place in those regions for which predictions were created. The volunteers movement is important, in the area of civil emergency response. Our cooperation with the customs, providing safety and security in regard to food production.

Classic theories of probability has not worked out well, predicting that, for example, flooding in certain regions would not occur again, and within a few years of the prediction, flooding took place in those regions for which predictions were created. The volunteers movement is important, in the area of civil emergency response. Our cooperation with the customs, providing safety and security in regard to food production.

Reto Schnarwiler, Managing Director, Swiss Re. government and public authorities, there is a lot of knowledge available on historic events and scenarios, that we need to get a hold of and come up with a risk landscape, based on that transparency of various risks, we could come up with various consequences.

Francesc Pla Castelltort, Deputy to the Executive Secretary of the EUR-OPA Major Hazards Agreement, Council of Europe. We are in the domain of multi-stakeholders is essential, the link between the scientific work and operations, but other aspects and stakeholders much be taken on board. Risk and resilience is a full network, making decisions at the individual level. National platforms in charge of defining important planning. Creating a demand for creating resilience and safety.

Francesc Pla Castelltort, Deputy to the Executive Secretary of the EUR-OPA Major Hazards Agreement, Council of Europe. We are in the domain of multi-stakeholders is essential, the link between the scientific work and operations, but other aspects and stakeholders much be taken on board. Risk and resilience is a full network, making decisions at the individual level. National platforms in charge of defining important planning. Creating a demand for creating resilience and safety.

Dr. Valery Sorokin, Professor, Gubkin Russian State University of Oil and Gas. Global Marine Protection Initiative. Highlights one small important area of much wider challenge of managing major catastrophes. Preventing, preparing for and dealing with accidents of offshore oil and gas developments. Global annual output is 1.4 billion tons, 1/3 total is offshore. In spite of the experience of 70 years offshore, we must say that accidents happen in offshore rigs, underwater pipelines, and there is no guarantee that it will not happen.

Offshore oil and gas production are frontier energy enterprises. Avoiding risk most of the time, but sometimes something will happen, the accident claimed 11 lives, Deep Horizon platform, flushed tons of oil into the gulf. In the aftermath of the accident, Medvedev suggested at Global Marine Protection Initiative, to deal with these activities. 2010, since then subsequent Summit had some discussions. Establish mechanisms for best practices within the framework of G20. Very top down initiative, but not what it would seem, 10s of stakeholders are participating in our exercises.

Offshore oil and gas production are frontier energy enterprises. Avoiding risk most of the time, but sometimes something will happen, the accident claimed 11 lives, Deep Horizon platform, flushed tons of oil into the gulf. In the aftermath of the accident, Medvedev suggested at Global Marine Protection Initiative, to deal with these activities. 2010, since then subsequent Summit had some discussions. Establish mechanisms for best practices within the framework of G20. Very top down initiative, but not what it would seem, 10s of stakeholders are participating in our exercises.

Next Panel: Mind the Long-Term Risk: New Standards to Unlock Private Sector Infrastructure Investment.

Day One

6/20- 4PM, Afternoon session: IEA (International Energy Agency) Report launching. Medium Market Report 2013.

Maria van der Hoeven, IEA executive Director. First time every IEA launching a report in a partner country. Because gas markets and Russia go together, important to see, gas remains a fuel of contradictions, stubbornly resists globalization, even in regions affected by energy poverty, gas flaring persists. Gas will emerge as a transportation fuel, natural gas vehicles, will have a bigger impact in reducing oil demand than renewables combined.

Maria van der Hoeven, IEA executive Director. First time every IEA launching a report in a partner country. Because gas markets and Russia go together, important to see, gas remains a fuel of contradictions, stubbornly resists globalization, even in regions affected by energy poverty, gas flaring persists. Gas will emerge as a transportation fuel, natural gas vehicles, will have a bigger impact in reducing oil demand than renewables combined.

Laszlo Varro, Head, IEA Gas Coal and Power markets, about to speak. LNG exports from United States coming up. Sabine and a few other LNG terminals just coming. Persistent tightening of natural gas is a concern, consequences more widely, ongoing competitiveness of coal in Asia, with impacts on emissions.

Laszlo Varro, Head, IEA Gas Coal and Power markets, about to speak. LNG exports from United States coming up. Sabine and a few other LNG terminals just coming. Persistent tightening of natural gas is a concern, consequences more widely, ongoing competitiveness of coal in Asia, with impacts on emissions.

As LNG emerges as export to Europe, creates recovery of supply and export to Europe by Russia, and increased investment in US infrastructure (gas).

As LNG emerges as export to Europe, creates recovery of supply and export to Europe by Russia, and increased investment in US infrastructure (gas).

China, holds large scale reserves, perhaps comparable to US, but proving difficult to recover, complex geography, water scarcity, regulatory impediments, population proximity. 2020 China will be dominated not by shale but other forms of gas (tight) and imports. Europe same story as China, but also public acceptance is also a big issue, and how important how public confidence is primary.

Spilling over of gas from United States more than development. Okay. Laszlo is up:

Global gas is still gold. However, that said, GG consumption will slow down, due to EU demand and ME/Africa supply. But. Uptick on gas soon. Round the world tour begins with US — continues to dominate non-conventional development. Better seismic, drilling and fracking, “mass manufacturing” methods in oil field services, strong financial boost from liquids. Wow. Commercial development of Gas would be greater than any outside US production.

Security issues, depletion and domestic demand growth lead to tight LNG supply. Within the next 5 years, decline in gas from ME, which has positive impact on global demand. Very large investments in Australian LNG — biggest investment base, 150 billion dollars, 85 percent taken in by Asian countries, non-spot market.

Security issues, depletion and domestic demand growth lead to tight LNG supply. Within the next 5 years, decline in gas from ME, which has positive impact on global demand. Very large investments in Australian LNG — biggest investment base, 150 billion dollars, 85 percent taken in by Asian countries, non-spot market.

“So, if I connect high productivity in the US with tightening global supply, that would mean increased US LNG export, soon turning US into number 3 global gas exporter (contingent on Japan contracts).”

China moving to handle emissions from coal, air quality is emerging as the key question and gas is the answer. New gas heating in 3.5 million homes, 7 million tons of industrial coal consumption replaced by gas. Chinese non-conventional gas developments can not keep up with demand. China’s import needs are growing immensely.

Russia still needs to develop infrastructure in harsh climate conditions in order to fulfill request exports in China. Japan, nuclear restoration stabilizes LNG demand and eliminates need for oil. Europe, Bah, never really recovers to the pre-financial crisis level. Shale gas in Europe are not going to make the kind of shale revolution akin to US.

Russia still needs to develop infrastructure in harsh climate conditions in order to fulfill request exports in China. Japan, nuclear restoration stabilizes LNG demand and eliminates need for oil. Europe, Bah, never really recovers to the pre-financial crisis level. Shale gas in Europe are not going to make the kind of shale revolution akin to US.

Natural gas automobiles. Natural Gas in transport in United States and China. In US, readily available supply, in China, mainly because of air quality concerns. US next 5 years will be about building up infrastructure to deliver gas, rolling out LNG trucks, CNG buses and trucks, deliver 120 thousand barrels a day.

Natural gas automobiles. Natural Gas in transport in United States and China. In US, readily available supply, in China, mainly because of air quality concerns. US next 5 years will be about building up infrastructure to deliver gas, rolling out LNG trucks, CNG buses and trucks, deliver 120 thousand barrels a day.

Prices. $4 mbtu in US, $10mbtu in Europe; $20 mbtu in Asia.

Possible game changer — if I have to think about it: methane hydrates in Japan.

Significant gas growth in Asia. Russian Pacific and Arctic, not cheap but the good news is that Australian projects are not cheap, and off-shore Africa is not cheap. But the question is will they be as profitable as pipeline projects. No.

Political volatility. How about demand volatility, presumes global integration of gas markets. In Europe in particular, would you expect the arrival of US energy supply in the markets, that national governments would impose gas consumption as part of climate change and lower prices?

Maria — we see a shift from natural gas to coal and there could be a shift to gas as a partner fuel to renewables.

Laszlo on China. They will shift to gas, just like London did to get off of coal in the 1950s. If you want to heat a million buildings in China, it cannot be done with nuclear, but only with coal or gas. This issue will drive gas demand even at reasonably high prices.

6/20, after lunch: Overcoming Energy Sector Bottlenecks to Gain Supply Stability (in cooperation with Goldman Sachs). Geffrey Currie, Global Head of Commodities Research Goldman Sachs International.

Alexander Novak, Minister of Energy of the Russian Federation, talking about possibilities of stability of supply and infrastructure for nonconventional. Just on Monday altered the taxing law for stimulating (concessions for lower permeable horizons) unconventional oil (40 percent discounts) to ensure recovery of a few billion barrels of oil (recovery). We also agreed with Ministry of Finance, over differences of taxation, just issue additional rules and regulations, no additional commitment for separation for unconventional, sending a good signal to market for increasing recovery ratios.

Jean-Pascal Tricoir, President CEO Schneider Electric, we supply technology to oil and gas industries, we also develop technology for energy efficiencies (smart grids, smart cities) for energy consumption. Internet, connecting people to people, but the next 15 years will be about connecting machines to the internet and people to the environment [see below talk this morning which he gave the same]. Helping the automation of pipelines making them more secure and enabling faster trading. On the downstream, very often people consumer in peaks, and now developing technologies to optimize these peak periods.

Jean-Pascal Tricoir, President CEO Schneider Electric, we supply technology to oil and gas industries, we also develop technology for energy efficiencies (smart grids, smart cities) for energy consumption. Internet, connecting people to people, but the next 15 years will be about connecting machines to the internet and people to the environment [see below talk this morning which he gave the same]. Helping the automation of pipelines making them more secure and enabling faster trading. On the downstream, very often people consumer in peaks, and now developing technologies to optimize these peak periods.

J. Currie — Shale on global energy markets, far reaching on oil and gas, and coal markets. Gas is displacing the coal on US markets and we are about to overtake Russia on coal export. Why did this take place in the United States. They simply outspent the rest of the world. The largest scale. Fiscal regime, low and stable tax regimes attracted a lot more investment, but having a global impact of shale revolution. “Direct my next question to Dr. Daniel Yergin, how will shale gas develop further and bottlenecks”.

Daniel Yergin, world’s logistic system needs to adjust to two things, incredible demand and growth in production. Remember in 2008, we were saying US would run out of oil, and since then it has increased by 50 percent. In natural gas, it has gone up 26 percent over the past 6 years. How quickly will this go to the rest of the world? Given the oil and gas industry is global. First, all shales are not the same, requirements for ascertaining what is actually in the ground, and what developments of industry are available to extract the resource. Questions below and above ground, regulations versus technical capacity for recovery, misperceptions that stand in the way of development, and ownership. In the US, individuals opened up mineral rights which is a great incentive for ownership, a lot of that will depend on the fiscal regime, governments, and public, and what I see in this past year is recognition by the world of what is going on in the United States.

Daniel Yergin, world’s logistic system needs to adjust to two things, incredible demand and growth in production. Remember in 2008, we were saying US would run out of oil, and since then it has increased by 50 percent. In natural gas, it has gone up 26 percent over the past 6 years. How quickly will this go to the rest of the world? Given the oil and gas industry is global. First, all shales are not the same, requirements for ascertaining what is actually in the ground, and what developments of industry are available to extract the resource. Questions below and above ground, regulations versus technical capacity for recovery, misperceptions that stand in the way of development, and ownership. In the US, individuals opened up mineral rights which is a great incentive for ownership, a lot of that will depend on the fiscal regime, governments, and public, and what I see in this past year is recognition by the world of what is going on in the United States.

Currie asking Yergin again: how do you see the long-term price of oil. “Well, certainly as you say, there is a floor [price] under oil”. If you were looking at the build up of supply and low demand growth, but prices are sensitive to politics, paces of development, switching, peak demand on global basis — rather than say “price will be this or that”, need to look at the factors that will shape prices, absent political conflict,

Currie asking Yergin again: how do you see the long-term price of oil. “Well, certainly as you say, there is a floor [price] under oil”. If you were looking at the build up of supply and low demand growth, but prices are sensitive to politics, paces of development, switching, peak demand on global basis — rather than say “price will be this or that”, need to look at the factors that will shape prices, absent political conflict,

Frontier supply. Question to Taner Yildiz, Minister of Energy and Natural Resources of the Republic of Turkey, Black Sea. What will governments need to do to attract invests, particularly in frontier. Now Taner is talking without a translator so no one in the room knows what he is saying.

Okay, now we hear what is going on. “We have very positive economic results, doubled energy consumption, second in Europe in energy consumption, positive in this sense and confidence in our future, located on the Euro-Asian portion of the continent, and looking to develop our relations with Azerbaijan, together with many projects. One focus on natural gas and oil, and what is important is pricing, political perspective, globalized. Everything is being globalized and glad that we can talk about it.

Kurdistan Ah-Rani [?] [name?] talks about new pipelines [impossible to hear him, feedback in the ear speaker, and it is too low to hear what he is saying]. Questions about legality and rate of returns ensue in Baghdad, attempting to figure it out.

Currie — US, imbalanced, with production bottlenecked, Asia, totally tight right now because of Fukushima, demanding substantial levels of LNG and finally Europe, stable but over regulated. Question to Sergei Kirienko, General Director, State Atomic Energy Corporation, ROSATOM.

Currie — US, imbalanced, with production bottlenecked, Asia, totally tight right now because of Fukushima, demanding substantial levels of LNG and finally Europe, stable but over regulated. Question to Sergei Kirienko, General Director, State Atomic Energy Corporation, ROSATOM.

Kirienko. Go Nuclear. What does it mean for shale/

Wintershall.mmdcx [?]

Yergin, what’s going to happen in the next wave of nuclear technologies. “I’ll make a prediction that by 2030s natural gas will have take over oil and coal, and that means that shale gas is much more important, second issue is electricity storage, and third thing, efficiency”.

6/20 – morning sessions: First day of the SPB Economic Forum, sitting in an early panel on G20 discussions titled, Innovation and Development as Global Priorities. 5 billion people without internet. Digital inclusion as a basic necessity such as water and electricity.

Aysegul Ildeniz, Head of Intel META, talking about gender gap in emerging markets, 25 percent less usage by women and 45 percent less in sub-Saharan Africa. Examples from Turkey, Facebook and Twitter usage, directly voicing the social change they want in the country, expressing participation that would not otherwise be necessary. Public-private (“like most people in this room”) partnerships that make the difference.

Aysegul Ildeniz, Head of Intel META, talking about gender gap in emerging markets, 25 percent less usage by women and 45 percent less in sub-Saharan Africa. Examples from Turkey, Facebook and Twitter usage, directly voicing the social change they want in the country, expressing participation that would not otherwise be necessary. Public-private (“like most people in this room”) partnerships that make the difference.

Jean-Pascal Tricoire, President, Schneider Electric, new subgroup talking about energy. Impact of IT technology on energy sector. Lack of energy takes a big toll on anyone’s life. Seven billion persons, only 2 billion have access to energy. If you focus on electricity will be multiplied by 2 in the next ten years, investing more in the next 20 years since its design since the beginning of electricity. Huge challenge also around climate change.

Cities – 2 percent of population, 80 percent of energy consumption. If we do not design a new mode of living in the cities, we will be deadlocked.

If internet over the past 20 years was connecting people to people, the next 20 years will be about connecting people to their environment (buildings, factories, cities), connecting 100 times more machines than people. Distributed energy generation. Two tremendous energy transitions. Access to energy for all. Smart cities, connected communities, job creation.

If internet over the past 20 years was connecting people to people, the next 20 years will be about connecting people to their environment (buildings, factories, cities), connecting 100 times more machines than people. Distributed energy generation. Two tremendous energy transitions. Access to energy for all. Smart cities, connected communities, job creation.

Igor Drozdov moderator, Senior Vice President, Skolkovo Foundation introduces Fulvio Conti, CEO Enel Group. F. Conti- the world is dividing into two pieces, those with energy and those without. Looking to create energy that is cheaper, reliable and sustainable. Cheap: model for energy should be market-based, the guidance for any investment. Giving access to 1.4 billion requires 1 trillion dollars over the next 10 years. You can get some of that back from government but most will come from users. Subsidies are an issue in business, keeping the price too low or high is a non-market transfer. Any kind of subsidy should be up for discussion, requiring a balanced approach, using any kind of energy available.

Whatever you use, oil, nuclear, all has to be based on cost without subsidies. New technologies bring the best possibilities for energy development. Electricity is paramount in discussion on sustainability.

Whatever you use, oil, nuclear, all has to be based on cost without subsidies. New technologies bring the best possibilities for energy development. Electricity is paramount in discussion on sustainability.

You need to have systems without impact. Guidance on market basis that will guide executives on emission reduction. Decarbonizing economy, market driven, polluter pays, or incentives for new technologies.

OMZ’s Vadim Makhov, energy balance, growth of energy consumption higher than growth of population. “I fully agree that look at wastes and improve energy efficiency”. After energy efficiency is renewables.

Renewables growing sector even in compounded aggregate growth rate was 30 percent. Last year was 3 billion. We still have a question of what the bridge fuel will be.

Competition between coal and natural gas. Despite clean coal technology, some years remain to develop commercialization of reliable production. Natural gas better, best compliment to renewables, reliable, available, and less carbon footprint. Other big companies, Rosneft, announcing more natural gas fueling stations. Something needs to be done shifting over to natural gas.

Patrick Kron, CEO Alstom. Re-stressing importance of electricity. Wants to diverge on some points: (1) major challenge providing electricity to planetary inhabitants. “I don’t think one energy is bad or good, coal, gas, renewables, should be decided nation by nation basis, what is available”. (2) We need to provide massive energy but deal with global warming, curb emissions (a) improve efficiency along the power chain, address electricity 40 percent efficiency, sequestration CO2, (b) clean technologies are critical for high job drivers and long term policies.

Patrick Kron, CEO Alstom. Re-stressing importance of electricity. Wants to diverge on some points: (1) major challenge providing electricity to planetary inhabitants. “I don’t think one energy is bad or good, coal, gas, renewables, should be decided nation by nation basis, what is available”. (2) We need to provide massive energy but deal with global warming, curb emissions (a) improve efficiency along the power chain, address electricity 40 percent efficiency, sequestration CO2, (b) clean technologies are critical for high job drivers and long term policies.

(1) Ask the question What is a clean technology? (2) Make sure we promote green technologies all over the world (3) CO2 pricing mechanism. “We are not in the charity business so pace yourselves on the IT discussion”.

Speaker from audience. “Business has a crucial role in social planning”.

Use of Biotechnologies. Speaker [?]. Crop productivity because of industrial biotechnology. Chickens are fed with enzymes and microbes. Every chicken eaten (practically). Energy sector. Laundry is no longer washed at high temperatures, but lower temperature, because of enzymes included in detergents, and these changes will accelerate. Use of biofuels in corn, in the US, 10 percent, US farmers (next to Canada) are the largest fuel producers in the United States, in participation with biotechnologies.

Regional and national plans, de-risking, market based approaches.

Viktor Vekselberg, President, Skolkovo Foundation, Task Force Chairman, with the last word, stating a number positive suggestions, hoping the task force will continue to cooperate and work together, including market motivating comments, “We should not support any form of protectionism, local support of promoting national economies will go nowhere”.

Viktor Vekselberg, President, Skolkovo Foundation, Task Force Chairman, with the last word, stating a number positive suggestions, hoping the task force will continue to cooperate and work together, including market motivating comments, “We should not support any form of protectionism, local support of promoting national economies will go nowhere”.

NEXT Panel: Delivering Growth Capital To Russia’s Entrepreneurs

. It is absolutely freezing inside this Conference hall. There are a lot of panels going on, but I want to sit this out and wait for this upcoming panel on Entrepreneurship in Russia. About 15 minutes wait and already, there are several cameras in the room, and the seats are filling up.

Folks are really photo-op crazy here at the SPB economic forum, a veritable photo frenzy…

Here we go.

Simon Nixon, Chief European Commentator, Wall Street Journal. Introducing Pekka Viljakainen, Chairman, All Capital. Speaking about his work, advisor at Skolkovo, raising capital for infrastructure projects. Giving a lecture about “smart money”. Biggest barrier for smaller companies — not corruption, regulation, politics, governmental issues — but lack of trust. When you speak to entrepreneurs in smaller cities, the question is “why do I need your money, are your going to take my company” — Russia is about personal friends, without trust, no investment should be made here. Every single investor, everyone knows, the weak point, is the minority investor, “short version, is if you have less than 50 percent, you will be screwed”.

Simon Nixon, Chief European Commentator, Wall Street Journal. Introducing Pekka Viljakainen, Chairman, All Capital. Speaking about his work, advisor at Skolkovo, raising capital for infrastructure projects. Giving a lecture about “smart money”. Biggest barrier for smaller companies — not corruption, regulation, politics, governmental issues — but lack of trust. When you speak to entrepreneurs in smaller cities, the question is “why do I need your money, are your going to take my company” — Russia is about personal friends, without trust, no investment should be made here. Every single investor, everyone knows, the weak point, is the minority investor, “short version, is if you have less than 50 percent, you will be screwed”.

“If I want to triple my money within 5-10 years, Russia’s SME and Internet market is extremely attractive.”

Turning now to Sir Suma Chakrabarti, President, Bank for Reconstruction and Development. Biggest killer for new entrepreneurs is concentration of economic power in three sectors: (1) energy industry; (2) geography (within certain locations); (3) State still owns too much.

Turning now to Sir Suma Chakrabarti, President, Bank for Reconstruction and Development. Biggest killer for new entrepreneurs is concentration of economic power in three sectors: (1) energy industry; (2) geography (within certain locations); (3) State still owns too much.

Needs repeating, with concentration of power, you have vested interests. Red tape and bureaucratic hurdles are a big problem. In our marketing of Russia to foreign investors, old investors, easy to do — quite easy to do repeat business. But new investors, very difficult. The more Russia is interlinked with global economy, the more entrepreneurship will be standardized, for example, especially in management skills area. “Foreign investors don’t like the top down approach”. SME’s (small and medium enterprises) are doing well.

Now up is Sergei Borisov, VP for Small Business Development, Sberbank. We have a lot of problems on SME. We have 6000 entrepreneurs every year, and looking for solutions, and I would agree with the lack of trust issue, but we also have a lack of knowledge and skills. Business plans are not fulfilled, payments fall behind, delivering access to capital and lack of loans. 30 percent were saying they were lacking loans, getting better, 22 percent these days. Interest rate is 19.5 percent. Thinking about how to decrease this rate.

Now up, Mark Haefele, Global Head of Investment, Chief Investment Office of Wealth Management UBS. Going to give a background on where UBS is, and then what he does, his view on SME lending globally. Been in Russia since 1997 as global wealth manager, bring billions of dollars to Russia and provide lending in the national structure.

Now up, Mark Haefele, Global Head of Investment, Chief Investment Office of Wealth Management UBS. Going to give a background on where UBS is, and then what he does, his view on SME lending globally. Been in Russia since 1997 as global wealth manager, bring billions of dollars to Russia and provide lending in the national structure.

Russia has done a lot to bring attention to this SME issue (including this panel) — and SME is difficult globally. UK is ranked no. 1 by World Bank for SME, but still, low by comparison with what money is available. Germany to Spain there is 2 percent difference. So SME is a problem that extends well beyond Russia.

Andre Sharonov, Deputy Mayor for Economic Policy Moscow. The task of decentralizations should be done by market not by government. We have typically attempted to involve everyone but that does not work well, and the government should be not replacing independent institutions and the market mechanisms. However, I would agree with the banks’ problems with spreading money around the SMEs. Very often, the entrepreneurs themselves and the government that follows suit, say that all problems fall down to lack of capital. But in fact, a non-competent experience or actions, very often, entrepreneurs mostly need the mentorship and knowledge.

Specific tools used by Moscow used to stimulate SMEs — (1) Subsidies, when there are special people or market instruments, we are a compliment, but that we should lose our money only in the last instance. Everywhere where governmental money is spent, it should be married with private money. Track records of Moscow investment fund, takes certain risks if a company goes on default. And our task is to deliver the leverage; Micro financing support. Also, measures that reduce the need for financing. We cannot cover all SMEs and we find that innovative entrepreneurs. Finally, we continue to support business innovations.

Pekka with final note on SME. Do not look for money from the bank. Will not happen. Get the money from private investors. The business angels. Make that money fly faster. The Banks will not help.

Pekka with final note on SME. Do not look for money from the bank. Will not happen. Get the money from private investors. The business angels. Make that money fly faster. The Banks will not help.

Why is the interest so high? Is is structural?

Pekka speaking again on another topic, the success of building new economics is how much private money is channelled to private companies. How easy or difficult to start a business. We did it through Skolkovo services within 42 days. We have a company, book keeping, bank account. More than in Finland or Australia, but it is not that bad. The answer for money is regional.

Pekka speaking again on another topic, the success of building new economics is how much private money is channelled to private companies. How easy or difficult to start a business. We did it through Skolkovo services within 42 days. We have a company, book keeping, bank account. More than in Finland or Australia, but it is not that bad. The answer for money is regional.

Chakrabarti: Business environment survey in Russia, website, which can tell you where to start a business. Second, things are getting easier. Mark H., you don’t have to listen to Mr. Bulldozer (P. Viljakainen) for very long to realize how to go about things. The best thing I can say about attracting capital is speak to the issues of investors concern.

Sergei Borisov, The main problem is the Dutch Disease, where the oil and gas contracts and cash are inflating things.

Personal Attendance

6/15: A brief behind-the-scenes look at the “personal web office”.

6/15: A brief behind-the-scenes look at the “personal web office”.

Much of the information and access codes to move through the site is event-confidential. I have altered the screen shots by darkening out sensitive data. I want to provide availability to the aesthetics of SPIEF participation back-stage. The SPIEF website itself provides ample information about participants, programs — just about everything to imagine about the goings, with the exception of personal attendance.

There are a number of advance practices for obtaining an invitation. I will focus briefly on what takes place after having obtained via email an invitation.

Here are two images that give you a sense of how to manage one’s identity on the SPIEF website.

Here are two images that give you a sense of how to manage one’s identity on the SPIEF website.

The first includes the personal codes (blackened out) for entering your personal web page

The second image, the data page,requires uploading your personal image.

There is a badge presented at various accreditation booths in the city, usually at high-end hotels.

There is a badge presented at various accreditation booths in the city, usually at high-end hotels.

The accreditation process takes about 10 minutes. The SPIEF allows accreditation to take place directly upon arrival at the airport.

Here are some photographs from previous years that I attended, at the airport.

There are quite a few billboards at the airport that advertise the SPIEF event.

There are quite a few billboards at the airport that advertise the SPIEF event.

Throughout the city, a tourist would see numerous billboard advertisements concerning the SPIEF.

English is ubiquitous in relation to the SPIEF. The emphasis on English language at the SPIEF gives the impression of not having left London or one of the Nordic cities, where English is fluently spoken.

Read Full Post »